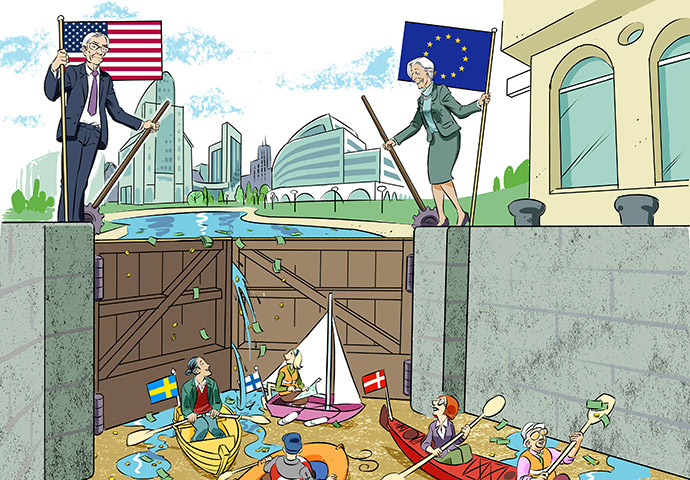

Property Market Liquidity – when will the floodgates open?

What factors contribute to periods of frantic activity, followed by “Property crunches” with liquidity drying up? In this article, we analyse the driving factors behind swings in liquidity. What triggers the ups and downs in the transaction market?

Property shares in turbulent times – What do we know? How can we act?

What do shares in property companies offer investors? Exposure to property, exposure to the stock market or both? How are properties and property shares linked? In this article we will try to establish how all this works. For illustrative purposes we will use the Swedish market, but the principles and mechanisms are the same in any jurisdiction.

Inflation – a blessing or a curse?

After decades of low inflation, the ugly face of inflation seems to be appearing again. How will rising inflation impact property markets? Do property investments constitute a hedge against inflation? Or, more worryingly, will increasing interest rates push the property market off the cliff?

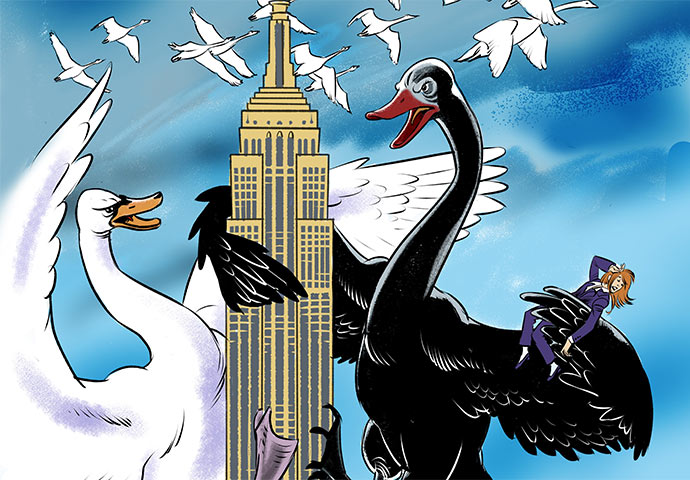

This time is different? A comparison of crises in the Nordics

The property sector in the Nordics has been hit by many crises; some of them originated 'in-house' within the sector, some of them were triggered from outside of the sector, some were homecooked, nationally, and others were global. What has the impact of these crises been on the property sector and, more importantly, what conclusions can we draw with regards to the current COVID-19 pandemic? What can we learn from history?

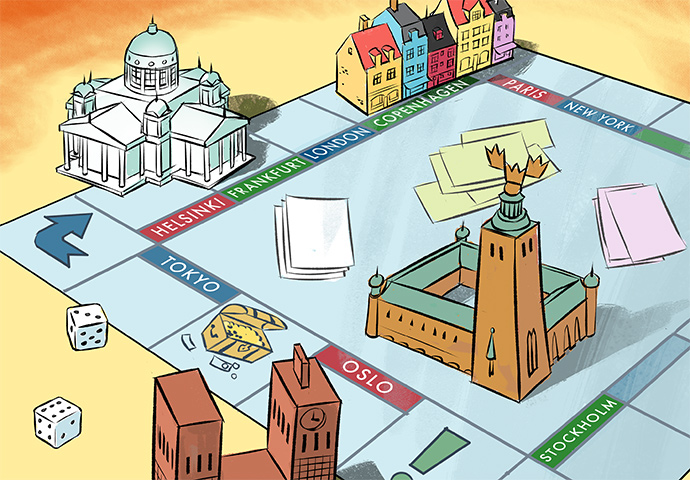

A tale of four properties – The Nordics: four countries – one market?

Are the Nordic countries a single market, from a property investor’s perspective? Do risk-return profiles differ between the countries? We will illustrate this with a Tale of Four Properties; the story of a fictional investor who bought one property in each of the Nordic capitals. In addition, currency regimes, interest rates and monetary policy are different in each country. How should an investor approach this? What is the impact on risk and returns?

Property – the holy grail of investments?

Does property offer an unbeatable combination of risk and return? Or are record low yields an indicator of a bubble? Furthermore, do secondary, high-yielding, properties have a more attractive risk-return profile than prime properties?

Listed real estate in the rearview mirror – From discount to premium

An intriguing characteristic of listed real estate is the parallel pricing of assets, i.e. that assets which are held by listed real estate companies are assigned a value not only by the stock market through the share price but also by investors on the direct real estate market. A listed company whose real estate portfolio is valued higher by the stock market than by the direct market is traded at a premium whereas in the reverse case that company is traded at a discount.

Same same but different – The Nordic property markets in a European perspective

For quite some time, Sweden, Finland, Denmark and Norway have attracted substantial interest from international property investors. For some investors, these four markets are profoundly different, whereas other investors might treat them as one due to their similarities with regard to institutions, language and social models.

The proper(ty) allocation – The role of property in portfolio management

The management of financial assets plays an important part in people’s lives. Many stakeholders are dependent on institutional investors’ ability to generate sustainable returns for their well-being. How can property contribute to meeting that objective?

Return of the Analyst – Does equity research add value?

The value of active investment management and equity research has been debated for a long time. Many studies have shown that actively managed equity funds fare no better than passively managed index funds, and that instead of composing equity portfolios based on research, investors might as well choose shares randomly. ‘Market efficiency’, it is argued, ensures that share prices reflect all relevant, publicly available information, leaving no money on the sidewalk for investors to pick up.

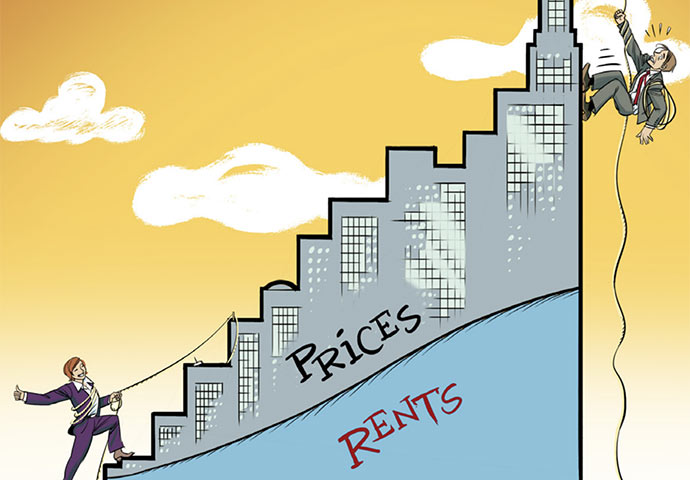

The rental peak – promise or peril?

Over the past thirty years, property prices have peaked when the prospects for rental growth have been limited. Similarly, as rents bottom out and expectations for rental growth should be high, few appear to be willing to invest in property. Can the rental market provide guidance to the direction of property prices, and if so; is there a strategy which allows investors to benefit from the prevailing market patterns?

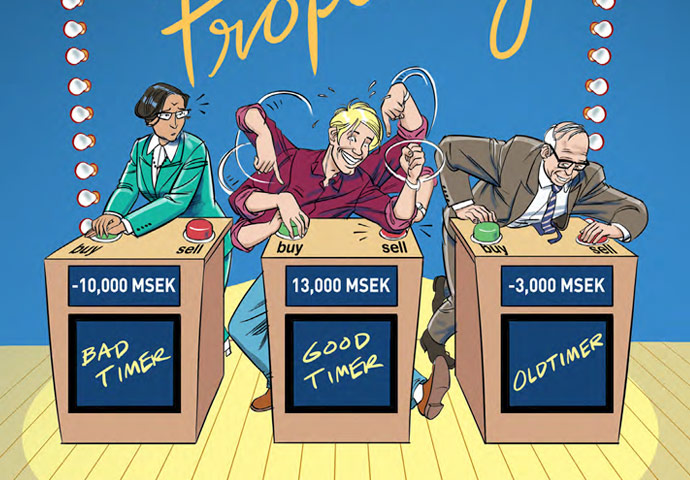

Buy cheap, sell dear – the importance of timing

Is timing the market possible, and if so; which investors have succeeded in buying in a bear market and selling in a bull market? Why have some investors performed better than others? This report aims to shed light on these issues by looking at a decade of transactions on the Swedish property market.

Property shares – property or shares?

What is the nature of property shares? Do they bring property market exposure or do they simply follow equity markets? Does it make sense for institutions to hold property shares in order to diversify away from equity markets or do property shares behave just like any other shares? Could property shares effectively replace direct property?

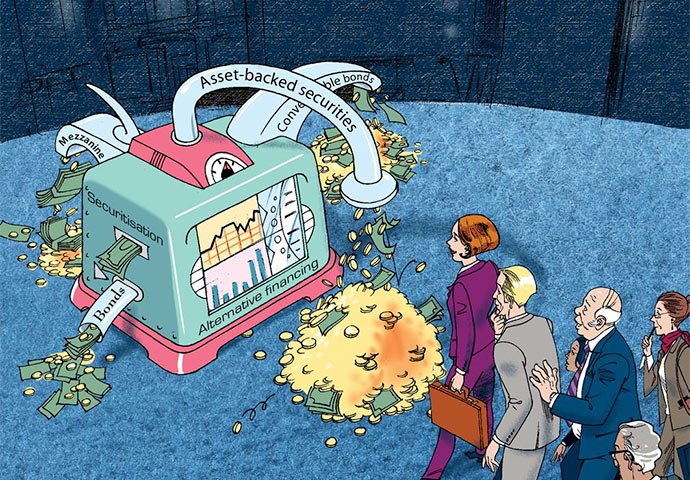

Tapping new sources: will alternative property financing close the gap?

The credit crisis showed that liquidity in the banking sector can dry up drastically. It also became apparent that an illiquid credit market has negative effects on the property market. For example, many property investors could not get acquisition financing at reasonable terms and as a consequence attractive investment opportunities were missed. What financing options are available post-crisis as alternatives to traditional bank debt? How can property investors take advantage of these opportunities?