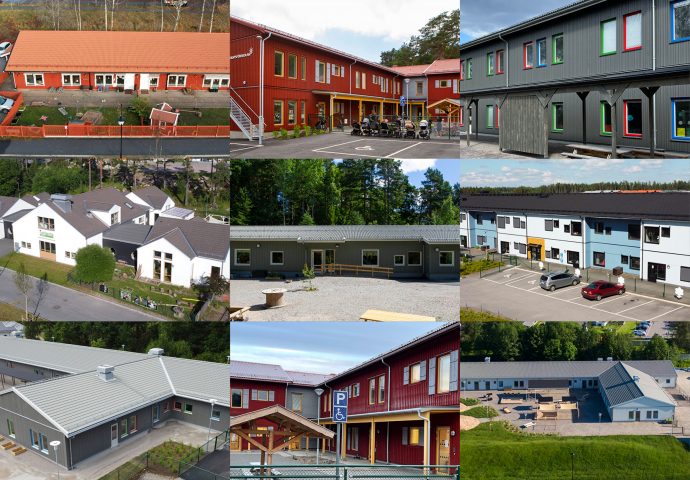

A truly pan-Nordic adviser for property related transactions

Nordanö was founded in 1992 and is a leading financial advisory firm for property related transactions in the Nordic region.

Since 1992, Nordanö has executed hundreds of transactions in the Nordics, many of which have been among the markets’ most accretive and eye-catching. In the last three years, the firm has advised on deals of over €7 billion. Nordanö is owned by partners. The team consists of 42 people with offices in Stockholm, Helsinki, Copenhagen and Oslo.

We are thrilled to have won in the Euromoney Real Estate Awards 2024 for best consultant in the Nordics, as well as in Sweden and Finland. The achievement is a testament to the dedication of our team, who relentlessly strive for excellence and providing value to our clients. Read more: The Nordics and Baltics’ best consultant for real estate: Nordanö

Nordanö has been awarded the Estate Media Danmark’s Transaction Award 2024. As a team we are incredibly honored and proud. The award is an industry recognized award with +4,000 real estate professionals having been active in the voting process. Read more